is medicare self funded or fully insured

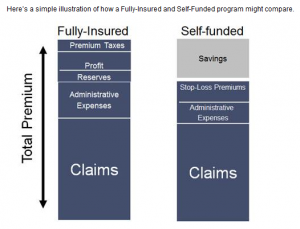

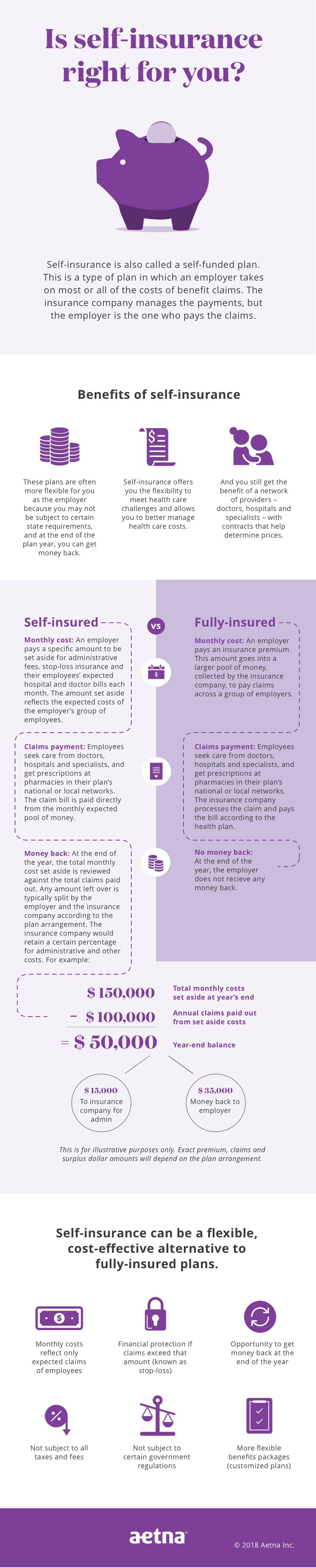

One big difference between a self-funded and a fully-insured plan is whether an employers unused money goes to an insurance carrier or stays in their own pocket. This option has the most risk.

Self Funded Vs Fully Insured Health Plans Youtube

Other sources like.

. On the other hand self-insured plans are funded and managed by an employer often in an effort to reduce premium costs. Self-funded or fully insured. Self-funded or fully insured.

A properly designed and executed self-funded group health plan enjoys some significant advantages over its fully-insured counterparts. Of the PHS Act that apply to group health plans that are non-Federal governmental plans are enforced by the Centers for Medicare Medicaid Services CMS under. As the cost of health care continues to rise businesses are always looking for ways to control costs without negatively impacting the health of their employees.

Level-Funded This type of plan is a combination of fully insured and self-funded. Your monthly premium only changes during the year if the number of enrolled employees in the plan changes. Fully-insured plans are more traditional than self-funded plans.

The choice of one over the other should not be made arbitrarily. Each type carries its own set of administrative rules and legal constraints. The Chamber Health Benefits Plan is a self-funded option that gives employers with 50 or fewer employees the opportunity to join other small businesses in a multiple employer welfare arrangement MEWA.

With fully insured plans premiums are paid directly to the insurer. A fully-insured health plan refers to a group health plan in which the employer or association purchases health insurance from a commercial insurer in order to provide coverage for its employees or association members. Group medical benefit plans for your employees typically fall into one of two categories.

Employers opt to self-insure because it allows them to save money if claims are at or below the expected level. Self-funded or fully insured. Most self-insured employers contract with an insurance company or independent third party administrator TPA for plan administration but the actual claims costs are covered by the employers funds.

Non-Federal governmental plans can operate as self-funded plans purchase a fully insured group insurance product or consist of a mixture of self-funded and fully insured options. These funds can only be used for Medicare. The choice of one over the other should not be made arbitrarily.

The risk assumed with either model is the chance that your employees will become ill and require costly treatment. While both fully-insured and self. However fully-insured plans are generally more expensive for employers as the name implies.

Self-insurance or self-funded insurance may be more flexible than traditional fully-insured plans and an important consideration for your overall strategy. These generally include the minimization of the amount of fixed or sunk costs the lowering of administrative costs the elimination of carrier profit margins and risk charges and the freedom from Federal and. With a self-funded self-insured health plan employers operate their own health plan as opposed to purchasing a fully-insured plan from an insurance carrier.

The self-insured employer uses its own funds to pay for medical coverage of its employees their spousespartners and their dependents. Basically the employer chooses a self-insured health plan as it can result in significant savings on premiums. The employer pays premiums to the insurer some of which are passed on to the employees via payroll deduction in trade for the.

Under an insured health benefit plan an insurance company assumes the financial and legal risk of loss in exchange. This protects the employer against higher-than-expected claims. Ad Find out the basics and how to get started.

Tax benefits are an attractive. Learn more about self-insured plans and whether or not. Employers with self-funded or self-insured plans retain the risk of paying for their employees health care themselves either from a trust or directly from corporate funds.

Under an insured health benefit plan an insurance company assumes the financial and legal risk of loss in exchange for a fixed premium paid to the carrier by the employer. Self-insured health insurance means that the employer is using their own money to cover their employees claims. However self-funding exposes the company to greater risk if the amount of.

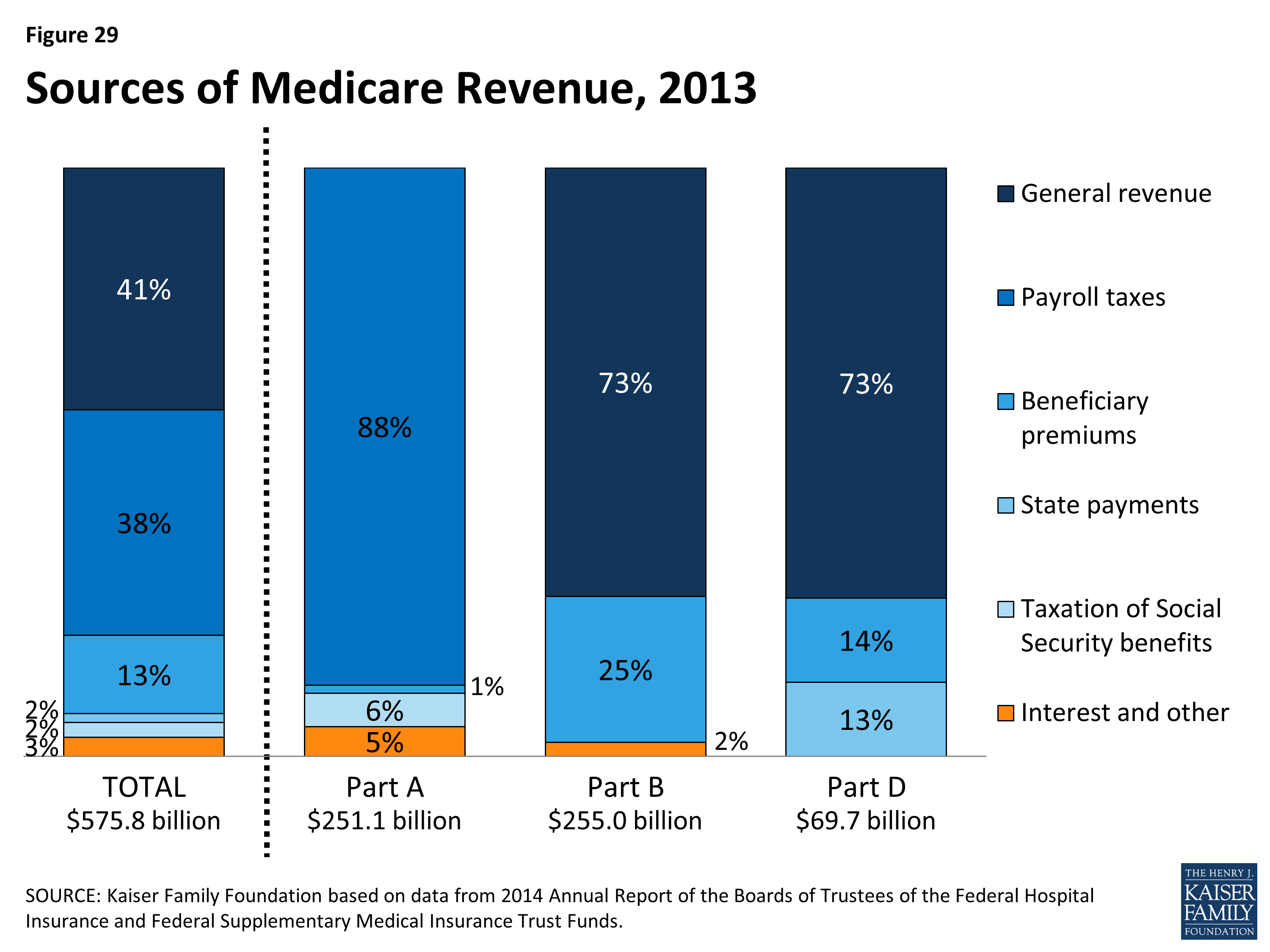

Medicare is paid for through 2 trust fund accounts held by the US. Group medical benefit plans typically fall into one of two categories. Self-insured is the traditional model of funding where a third-party insurance company takes on the financial risk of paying for medical claims in exchange for premiums paid to it.

The premium rates are fixed for a year and you pay a monthly premium based on the number of employees enrolled in the plan. Ad Search Top Medicare Plans In Your Area. Traditionally self-insurance methods have been used by.

MEWAs allow companies to share the healthcare costs of employees which in turn reduces group plan costs allows for better benefits options. Often touted as an excellent choice for small businesses level funded plans charge a set rate for premiums each month with companies receiving refunds when the amount paid in premiums exceeds that which was actually. Get official Medicare information here.

In a traditional fully insured health plan your company pays a premium. However each type of insurance carries its own set of administrative rules and legal constraints. This money comes from the Medicare Trust Funds.

The employer pays the premium directly to the insurance company and the premium is set on an annual basis. A fully-insured health plan is the traditional way to structure an employer-sponsored health plan and is the most familiar option to employees. Level funded health plans are a hybrid that incorporates elements of both fully insured and self funded insurance offerings.

The self-insured plan is also known as a self-funded plan as the employer is responsible for paying the medical claims and operating the health insurance plans with the help of vendors who are known as third-party administrators TPA. For other groups with a desire to do more we can look to alternative funding strategies such as Self-Funding to create tailored and lower cost plans. The premium is based on the number of employees that the employer has and.

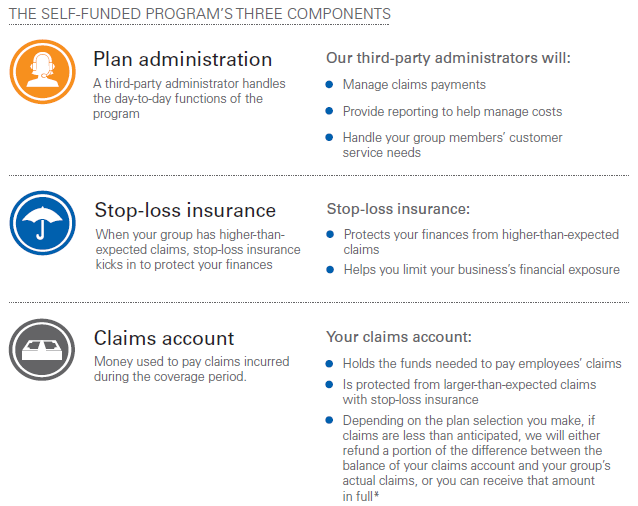

Click here to read complete document. Hospital Insurance HI Trust Fund How is it funded. Claims accountA claims account is exactly what it sounds like.

Stop-loss InsuranceStop-loss is an employers safety net. While fully-insured plans offer predictability and safety although at a cost. Explore Medicare Options Online Or Schedule a Call From Us Today.

All group medical benefit plans fall into one of two categories. They offer a fixed and predetermined premium per employee. Payroll taxes paid by most employees employers and people who are self-employed.

Both full-insured and self-insured relate to the funding of medical claims made by the plans participants. A portion of the monthly payment is used to pay for claims submitted by plan members. It is wise to have a stop-loss insurance plan in place to cover a situation when claims exceed what you anticipated and could cover.

Adobe reader or compatible required. Each type carries its own set of administrative rules and legal constraints. Fully-insured Plans With a fully insured plan the employer pays a premium.

Given the 2021 Milliman Medical Index estimated the annual healthcare costs for a typical household of four to be 28256 we have to ask how we can move the needle for American families.

The Pros And Cons Of Self Insured Vs Fully Insured Youtube

Using Level Funded Health Care Plans To Fuel Small Business Cash Flow Brokers Unitedhealthcare

Network Health Assure Level Funded

Fully Insured Vs Self Insured Vs Level Funded Plans Altura Benefits

What The Fund All About Fully Partially And Self Funded Health Plans Filice Insurance Services Llc

What Is Level Funded Health Insurance

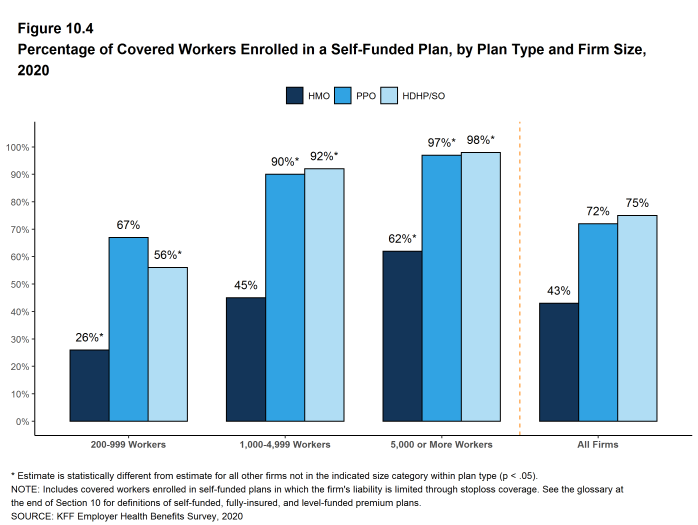

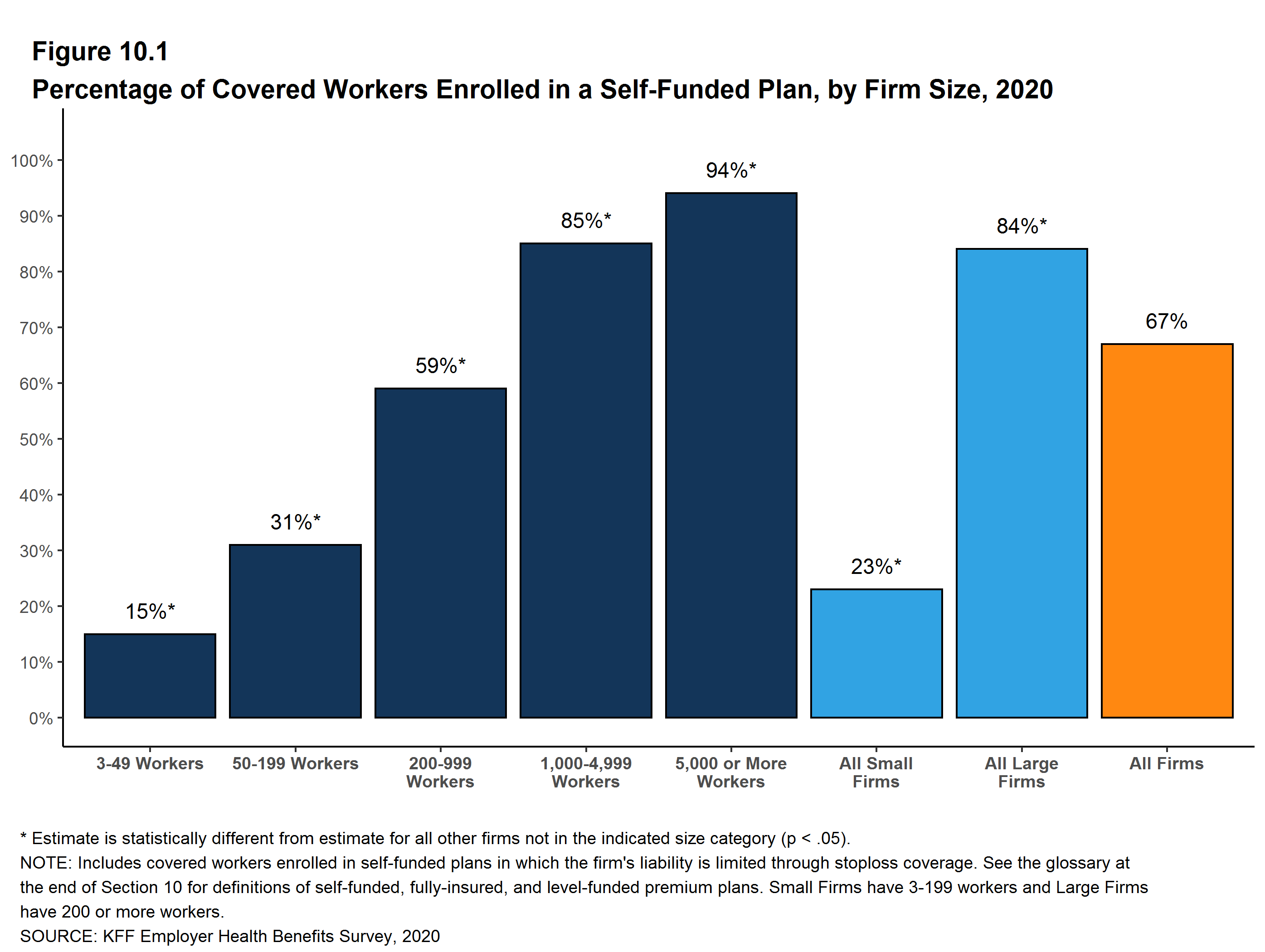

Section 10 Plan Funding 9540 Kff

Could A Self Funded Plan Be Your Best Option Indiana Group Health Insurance Nefouse Associates

Self Funded Plans Fringe Benefit Plans Inc

Self Funding Stop Loss Ppt Download

Self Level Funding Dickerson Employee Benefits

Self Funded Insurance Plans 101 Self Insured Vs Fully Insured Health Plans Aetna

Self Insured Plans Vs Medicare

Section 10 Plan Funding 9540 Kff

Self Funded Insurance Plans 101 Self Insured Vs Fully Insured Health Plans Aetna

Self Funded Health Insurance Plans Are A Money Saving Alternative For Small Groups Georgia Health Insurance Inc

A Primer On Medicare How Is Medicare Financed And What Are Medicare S Future Financing Challenges Sec 14 7615 04 Kff

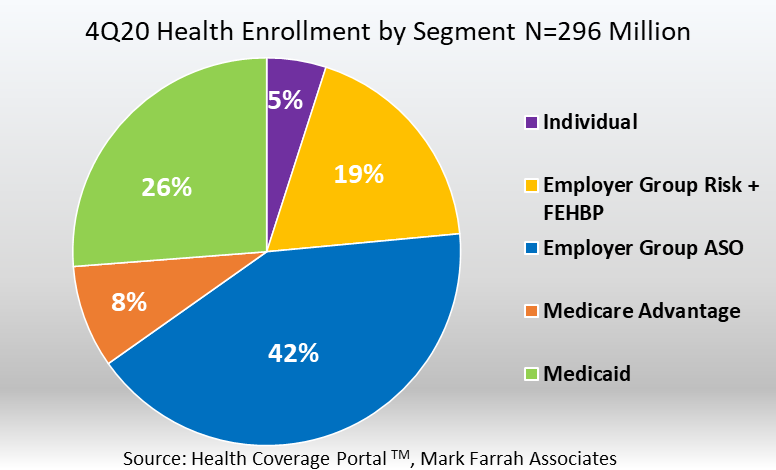

Year Over Year Health Insurance Enrollment Trends Amidst A Pandemic Era

0 Response to "is medicare self funded or fully insured"

Post a Comment